JUSTICE MANUAL 9-115.000 – Use And Disposition Of Seized And Forfeited Property

9-115.100 – Management and Disposal of Seized Assets

The United States Marshals Service (USMS) has primary authority over the management and disposal of seized assets in its custody that are subject to forfeiture or are forfeited under laws enforced by agencies within the Department of Justice as well as certain other federal agencies by agreement. Arrangements for property services or commitments pertaining to the management and disposition of such property are the responsibility of the USMS. The authority of the Attorney General to dispose of forfeited real property and warrant title has been delegated to the USMS director by 28 C.F.R. § 0.111(I).

Management and disposal of assets seized by agencies within the Department of Treasury and other agencies included by agreement (including certain agencies moved from Treasury to the Department of Homeland Security) are handled by property custodians (generally contractors) operating under Treasury guidelines. The Treasury agency case agent is generally the initial point of contact for issues relating to seized property custody, management, and disposal.

Prior to taking any action (e.g., in a settlement or plea agreement) concerning the management or disposition of property, the United States Attorney or agent in charge of the field office responsible for an administrative forfeiture case should consult with the United States Marshals Service in cases involving Department of Justice seizing agencies, or Treasury in cases involving Treasury seizing agencies, to discuss management or disposition issues. Such discussions shall address the impact that such proposed action may have on the United States Marshals Service or other custodial agency in undertaking, continuing, or terminating custody of the property. If the interests of claimants are to be satisfied in whole or in part by payments from the proceeds of a sale of the property by the Marshals Service or other custodial agency, the proposed forfeiture order should provide specific guidance for the Marshals Service or other custodial agency concerning such payments. In the case of any settlement or plea agreement that requires the payment of a specific amount, rather than an amount up to the proceeds of sale received in liquidation of forfeited property, approval must be obtained from the United States Marshals Service prior to the execution of the settlement or plea agreement. See Chapter 5 of the Asset Forfeiture Policy Manual (“Management and Disposal of Seized Assets”). The Money Laundering and Asset Recovery Section (MLARS) shall resolve any disputes that may arise in the event that the United States Attorney and the United States Marshal cannot agree on the appropriate resolution.

9-115.200 – Use of Seized Property by Department of Justice Personnel

Property under seizure and pending forfeiture may not be utilized for any reason by Department personnel, including for official use, until such time as the final order of forfeiture is issued.

Likewise, Department personnel may not make such property available for use by others, including persons acting in the capacity of a substitute custodian, for any purpose prior to completion of the forfeiture. However, court authority may be sought for use of seized property, after consultation with the United States Marshals Service, in situations such as the seizure of a ranch or business where use of equipment under seizure is necessary to maintain the ranch or business. See Chapter 5 the Asset Forfeiture Policy Manual (“Use of Seized Property by Department of Justice Personnel”).

9-115.202 – Use of Seized Property Where Custody is Retained by the State or Local Seizing Agency

To minimize storage and management costs incurred by the Department of Justice, state and local agencies which present motor vehicles or other property items for federal adoptions may be asked to serve as substitute custodians of the property, pending forfeiture, at the discretion of the United States Marshals Service or Treasury, and upon consultation with the United States Attorney in judicial forfeiture cases. In addition, the United States Marshals Service may enter into a storage and maintenance agreement with state and local agencies covering such property. Such agreements are contractual in nature, and do not require district court approval. Under such an agreement, the state or local agency has a responsibility to provide adequate storage, security, and maintenance for all assets in their custody.

Any use of such vehicles, including official use, by state and local law enforcement officials or others is prohibited by Department of Justice and Department of Treasury policy until such time as the forfeiture is completed and the equitable transfer is made. See Chapter 5 of the Asset Forfeiture Policy Manual (“Use of Seized Property Where Custody is Retained by the State or Local Seizing Agency”).

9-115.203 – Use of Seized Real Property by Occupants

As a general rule, occupants of real property seized for forfeiture should be permitted to remain in the property, pursuant to an occupancy agreement pending the final order of forfeiture, after consultation with the United States Marshals Service or Treasury and the United States Attorney. For additional information on this topic, see Chapter 5 of the Asset Forfeiture Policy Manual (“Use of Seized Real Property by Occupants”).

9-115.300 – Disposition of Forfeited Property

The disposition of property forfeited to the United States is an executive branch decision and not a matter for the court. Consequently, orders of forfeiture should be drafted broadly to direct forfeiture of the property to the United States “for disposition in accordance with law.” In addition, orders of forfeiture should specifically address any third party claims against the forfeited property that are recognized by the United States. If the interests of the claimant are to be satisfied in whole or in part by payments from the proceeds of a sale of property by the United States Marshals Service or Treasury, the proposed forfeiture order should provide specific guidance concerning such payments and, where possible, specify that such claims shall be paid only after the costs of the United States are recovered, and shall be paid only up to the amount realized from the proceeds of the forfeited property. The Attorney General has been given the authority to dispose of forfeited property “by sale or any other commercially feasible means” without subsequent court approval. See 21 U.S.C. §§ 881(e), 853(h), and 18 U.S.C. § 1963(f). This is generally called a “forfeiture sale” of the property. Forfeiture sales do not require judicial confirmation pursuant to 28 U.S.C. § 2001. See Chapter 5 of the Asset Forfeiture Policy Manual (“Disposal of Forfeited Property”).

9-115.310 – Disposition of Forfeitable Property by Interlocutory Sale

If before forfeiture, an interlocutory sale is necessary because the property is declining in value, and the interlocutory sale is contested, the procedures contained in 28 U.S.C. § 2001 should be followed requiring judicial confirmation of such interlocutory sales. When property is sold in this manner, it is called a “judicial sale.” If the sale is not contested, the provisions of 28 U.S.C. § 2001 need not be followed. Further information on this topic is available in A Guide to Interlocutory Sales and Settlements, MLARS, July 2007.

9-115.400 – Attorney General’s Authority to Warrant Title

Section 2002 of the Crime Control Act of 1990, which amends 28 U.S.C. § 524(c), gives the Attorney General the authority to warrant clear title upon transfer of forfeited property. Section 524(c)(9)(A) reads as follows:

Following the completion of procedures for the forfeiture of property pursuant to any law enforced or administered by the Department, the Attorney General is authorized, in her discretion, to warrant clear title to any subsequent purchaser or transferee of such property.

The authority to execute deeds and transfer title has been delegated to chief deputies or deputy U.S. marshals by 28 C.F.R. § 0.156. The section 0.156 authority predates the asset forfeiture program and applies to all court-ordered sales of property, not just forfeited property.

The preferred means to transfer forfeited property is by special warranty deed executed by the United States Marshal. The special warranty deed assures the grantee/buyer that the United States, as the current seller, has done nothing to encumber the property, nor has it conveyed any right, title, or interest in the property while the government was the owner of the property. In effect, the special warranty deed warrants the forfeiture process. Under appropriate circumstances, a quitclaim deed may be used to transfer property. The quitclaim deed makes no warranty representations. It serves only to convey whatever right, title and interest that the Government had as of the execution date. Finally, property may be transferred by a general warranty deed. It is Department policy to use general warranty deeds only in exceptional circumstances. As used in this policy, the terms “general warranty deed” and “special warranty deed” are not intended to be limiting in their application. In some states, warranty deeds are not used (e.g., in California a “grant deed” provides limited statutory warranties). The use of such state variations equivalent to a general warranty deed is satisfactory for purposes of this policy. See Chapter 5 of the Asset Forfeiture Policy Manual (“Attorney General’s Authority to Warrant Title”).

9-115.412 – Indemnification Agreement in Addition to Special Warranty Deed

It is suggested that the language of the special warranty deed be as follows, with the insertion of the specifically applicable circumstances as required:

The grantor covenants to specially warrant the title to the property hereby conveyed against any claim arising from … [insert the specifically applicable circumstances here.]

When special circumstances exist, the buyer may also request that the United States provide certain indemnifications in order to obtain title insurance. These indemnification agreements establish affirmative measures to be taken by the United States, beyond the basic terms and obligations of its warranty deed, in the event that claims are later made against the property. The indemnification agreement may be included either in the terms of the special warranty deed or in a separate document which incorporates the deed by reference. In either form, indemnification agreements will be limited to the following terms:

The United States will specially warrant its title against defects or clouds arising out of the forfeiture process, and hold the buyer harmless as a result of such defects in title or clouds involving the propriety of the forfeiture of the property.

In the event that a court in a final judgment rules that the United States did not acquire valid legal title to the real property through the forfeiture process and, therefore, was not able to convey clear title to the buyer, the United States will refund to the buyer the amount of the purchase price of the property, plus the value of any improvements made to the property by the buyer. The amount will be paid out of the Assets Forfeiture Fund, plus interest on the total amount at the current rate as provided in 28 U.S.C. § 1961 from the date of the purchase of the property by the buyer to the date of the final judgment.

The United States, by its special warranty deed, does not warrant the title of the prior owner of the property who acquired title before the forfeiture. See Chapter 5 of the Asset Forfeiture Policy Manual (“Use of a Special Warranty Deed and Indemnification Agreement”).

9-115.420 – General Warranty Deed

If the buyer of the forfeited property is unable to procure a title insurance policy with a special warranty deed and indemnification agreement, then the United States Marshal may be authorized to execute a general warranty deed. Any determination to transfer property by a general warranty deed must be approved by the United States Marshals Service Asset Forfeiture Office.

It is the policy of the Department that the Attorney General’s discretion to warrant clear title, through the use of a general warranty deed, will be exercised only in compelling circumstances where the financial advantage of offering a general warranty deed in the particular case, compared to the available alternatives, far outweighs both the potential cost of honoring the warranty in that case and the potential effect of increased purchaser demand for general warranty deeds in future sales of other forfeited properties. The United States Marshals Service Asset Forfeiture Office, in the exercise of sound business judgment, shall also consider the cumulative potential liability which will accrue over time as a result of each successive use of a general warranty deed. See Chapter 5 of the Asset Forfeiture Policy Manual (“Use of a General Warranty Deed”).

9-115.430 – Dispute Resolution

MLARS will resolve any disputes that may arise in the event the United States Attorney and the U.S. Marshal cannot agree on the appropriate form of deed to be used.

9-115.500 – Purchase or Personal Use of Forfeited Property by Department Employees

Department of Justice employees are prohibited from purchasing, either directly or indirectly, or using any property if the property has been forfeited to the government and offered for sale by the Department of Justice or its agents. In addition, Department of Justice employees are prohibited from purchasing or using such property that has been purchased, directly or indirectly, by a spouse or minor child. A written waiver to the aforementioned restrictions may be granted by the agency designee upon a determination that, in the mind of a reasonable person with knowledge of the circumstances, purchase or use by the employee will not raise a question as to whether the employee has used his or her official position or nonpublic information to obtain or assist in an advantageous purchase or create an appearance of the loss of impartiality in the performance of the employee’s duties. A copy of the waiver must be filed with the Attorney General. See Chapter 5 of the Asset Forfeiture Policy Manual (“Purchase or Personal Use of Forfeited Property by Department Employees”).

9-115.600 – Review of Official Use of Forfeited Property Valued at over $50,000

Part IV, D of The Attorney General’s Guidelines on Seized and Forfeited Property (July 1990) (JM Chapter 9-118.000) requires notification to the “Executive Office for Asset Forfeiture … at the time property valued at $50,000 or greater is placed into official use.” Although this requirement may be satisfied by post-transfer notification, the FBI and U.S. Marshals Service provided the then Executive Office for Asset Forfeiture with advance notice of and an opportunity to review such decisions. Such notification should now be made to MLARS.

MLARS should be given advance notice of and an opportunity to review official use actions involving federal forfeited property valued at $50,000 or more. MLARS will endeavor to act on all such notifications within two weeks of receipt. See Chapter 5 of the Asset Forfeiture Policy Manual (“Review of Official Use of Forfeited Property”).

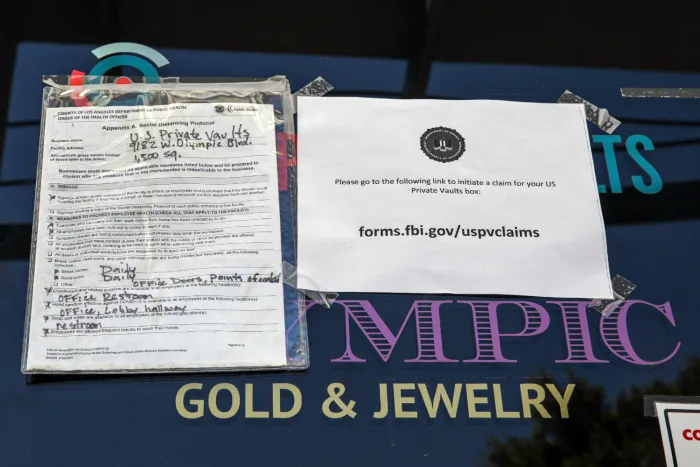

![PrivateProperty3-1250×650[1]](https://rucci.law/wp-content/uploads/2023/12/PrivateProperty3-1250x6501-1.jpg)

![shutterstock_120789925_0[1]](https://rucci.law/wp-content/uploads/2023/12/shutterstock_120789925_01.jpg)