Attorney Fees Under CAFRA

If your property was seized for forfeiture, representing yourself is not a good option. On the other hand, hiring an attorney can be expensive, even if the attorney takes the case on a contingency fee basis so that you do not have to pay anything unless you win the case.

In United States v. $107,702.66, 2016 U.S. Dist. LEXIS 12211, *2, the court explained: The court may choose to allow counsel, appointed to represent an individual in a criminal case, to also represent that individual in related civil forfeiture proceedings. 18 U.S.C. § 983(b)(1)(A). Additionally, individuals who are facing forfeiture of their primary residence are entitled to court-appointed representation. 18 U.S.C. § 983(b)(2)(A).

However, neither of these provisions provides any assistance to a person whose U.S. currency or funds from a bank account is seized by the Government when that person faces no corresponding criminal charges. For these individuals, the goal is getting the government to return 100% of the seized property with interest and pay all of the attorney fees and costs.

Keep in mind that if you file a claim for court action and the government agrees to return the property within its 90-day deadline, then there is no good way to force the government to pay your attorney fees. In other words, the government is not typically liable for attorneys’ fees incurred by the owner of the property if the government returns the property within 90 days of the verified claim being filed.

For this reason, if the government agrees to return your property within that 90-day deadline, then it never offers to pay your attorney fees and there is no good way to force it to do so. On the other hand, the government can be held liable for attorneys’ fees, costs, and interest when it fails to promptly return the property after missing the 90-day deadline, or when it files a complaint for forfeiture within that 90-day deadline, but does not “substantially prevail” in the action.

In some cases, the government will attempt to avoid paying attorney fees by moving to dismiss the case without prejudice. In those cases, your attorney should object to the dismissal or alternatively, request that the court dismiss the case with prejudice. Also, file a motion for attorney fees under both 28 U.S.C. § 2465(b)(1) and Rule 41(a)(2).

How To Get Attorney Fees in Civil Asset Forfeiture Cases

The government can be obstinant in these cases because they know that most people have no good way to fight back. Justice in these cases requires not just getting your money back quickly, but also getting the court to order the government to pay your attorney fees and costs.

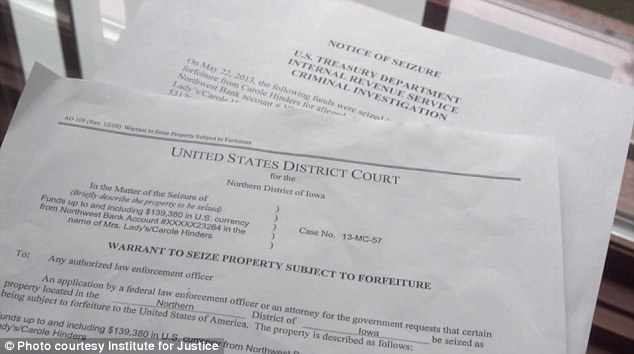

If your property was seized for civil asset forfeiture, contact Sebastian Rucci, an experienced civil asset forfeiture attorney. Depending on the circumstances, we take civil asset forfeiture cases on a contingency fee basis throughout the United States. We get many of our cases from other attorneys in another jurisdiction who contact our law firm to assist them in resolving their cases. We can help our clients file a verified claim within 35 days of the notice of seizure being issued. Filing the verified claim triggers a 90-day deadline for the government to either return the property or file a complaint in the U.S. District Court.

Sebastian Rucci

If the government files a complaint for forfeiture in the U.S. District Court, we can file a judicial “Claim in Interest and Contest of Forfeiture” pursuant to Rule G(5)(a), along with a motion to dismiss or answer and counterclaim. If the claimant substantially prevails in the lawsuit, we can file a “Motion for Attorney Fees” pursuant to 28 U.S.C. § 2465(b)(1). If the government files a motion to dismiss in an attempt to avoid paying attorney fees, then we can show why the government’s attempt to gain a “strategic advantage” or engage in “procedural gamesmanship” should be denied.

Forfeiture attorney Sebastian Rucci can also file a motion for attorney fees pursuant to the Court’s discretionary authority to award fees in connection with voluntary dismissal pursuant to Rule 41(a)(2). Contact attorney Sebastian Rucci to contest a wrongful or illegal seizure of money or other valuable property in a civil asset forfeiture proceeding. Whether your money was seized at the airport, from a bank account, or during a traffic stop, we can help. Call 330-720-0398.

CAFRA’s Provisions on Attorney Fees

As part of the effort to address overzealous Government actions in forfeiture cases, CAFRA provides for the recovery of attorney’s fees as follows: “(b)(1) Except as provided in paragraph (2), in any civil proceeding to forfeit property under any provision of Federal law in which the claimant substantially prevails, the United States shall be liable for – (A) reasonable attorney fees and other litigation costs reasonably incurred by the claimant….” 28 U.S.C. § 2465(b)(1)(A). Therefore, CAFRA requires the Government to pay the attorney’s fees of any claimant who “substantially prevails” in a forfeiture proceeding.

Although CAFRA provides that the government is liable for “reasonable attorney fees and other litigation costs reasonably incurred by the claimant” under 28 U.S.C. § 2465(b)(1)(A), the statute does not specify precisely how fee awards should be calculated.

Several cases address the proper method of determining an attorney fee award under CAFRA. Most courts have used the “lodestar method” to determine the amount to be awarded under CAFRA. See U.S. v. One Star Class Sloop Sailboat, 546 F.3d 26, 37-8 (1st Cir. 2008); U.S. v. $60,201, 291 F. Supp. 2d 1126, 1129-1130 (C.D. Cal. 2003). Under the lodestar method, attorney’s fees are determined by taking “the number of hours reasonably expended on the litigation multiplied by a reasonable hourly rate.” Trimper v. City of Norfolk, Va., 58 F.3d 68, 72 n.4 (4th Cir. 1995).

In some cases, the government will argue that the lodestar approach should not be used and that the attorney fees should primarily be based on the actual agreement between the Claimant and the Claimant’s attorney. Unlike other attorney fee provisions of federal law, CAFRA does not have a cap on hourly rates. See United States v. $60,201, 291 F. Supp. 2d 1126, 1130 (C.D. Cal. 2003). Instead, “Congress intended to liberalize the award of attorney fees, rather than restrict them.” Id.

Policy Reasons for CAFRA’s Provisions on Awarding the Claimant Attorney Fees

One of CAFRA’s most significant provisions allows a claimant who has substantially prevailed in a civil forfeiture proceeding to recover from the United States reasonable attorney fees and litigation costs. 28 U.S.C. § 2465(b)(1).

In United States v. $107,702.66, 2016 U.S. Dist. LEXIS 12211, *2-4, the court explained the policy reasons for CAFRA’s provisions on awarding attorney fees to the claimant: “Asset forfeiture is a powerful tool in the Government’s hands, made even more powerful by the fact that indigent claimants to the seized property are typically not entitled to court-appointed representation. Even otherwise non-indigent claimants may be unable to afford counsel, once the Government has seized their bank accounts.”

The court went on to explain that the House Committee on the Judiciary has described the potential effects on innocent citizens as follows:

Even should a property owner prevail in a civil forfeiture proceeding, irreparable damage may have been done to the owner’s interests. For instance, if the property is used as a business, its lack of availability for the time necessary to win a court victory could have forced its owner into bankruptcy.

If the property is a car, the owner might not have been able to commute to work until it was won back. If the property is a house, the owner may have been left temporarily homeless (unless the government lets the owner rent the house back). . . . [E]ven when the government’s case is extremely weak, the owner must often settle with the government and lose a certain amount of money to get the property back as quickly as possible. Id. (citing H.R. Rep. No. 106-192, at 17 (1999)).

Because of these concerns with the inherent inequalities in and potential for abuse of the civil forfeiture system, Congress enacted the Civil Asset Forfeiture Reform Act of 2000 (CAFRA), Pub. L. No. 106-185, 114 Stat. 202. See H.R. Rep. No. 106-192. The Act was “designed to make federal civil forfeiture procedures fair to property owners and to give owners innocent of any wrongdoing the means to recover their property and make themselves whole after wrongful government seizures.” Id. at 11.

Federal civil asset forfeiture cases require an attorney with knowledge and experience in all of the following fields: criminal law, Constitutional law, federal Admiralty procedure, the asset forfeiture scheme, and the attorney’s fees provision of CAFRA.

Reasons Why the Courts Should Award Attorney Fees in Forfeiture Cases

As U.S. Attorney General Eric Holder explained, “[f]orfeiture law is complex and requires specific expertise.” See Oversight of Federal Asset Forfeiture: Its Role in Fighting Crime: Hearing Before the Subcomm. on Criminal Justice Oversight of the S. Comm. on the Judiciary, 106th Cong. 110 (1999).

The fact that civil asset forfeiture cases are “so rarely challenged has nothing to do with the owner’s guilt, and everything to do with the arduous path one must journey . . . often without the benefit of counsel, and perhaps without any money left after the seizure with which to fight the battle.” H.R. Rep. No. 106-192 at 14 (1999).

Civil forfeitures involve a “risk that an innocent person will be deprived of his property.” United States v. $191,910, 16 F.3d 1051, 1069 (9th Cir. 1994). The risk is greater when the property owners lack effective counsel.

Congress created CAFRA’s fee-award provision, in part, to encourage private counsel to take forfeiture cases. In other words, the provisions on awarding attorney fees help facilitate legal representation for claimants.

In fact, the goal of the attorney fee provisions in CAFRA is to incentivize “private lawyers to become more involved in civil forfeiture cases.” See Louis S. Rulli, The Long Term Impact of CAFRA: Expanding Access to Counsel and Encouraging Greater Use of Criminal Forfeiture, 14 FED. SENT. R. 87, 88 (2001).

Congress worded CAFRA’s fee-award provision in the way that it did: “to liberalize the award of attorney fees” in federal civil forfeiture cases, and thus make it easier for property owners facing wrongful civil forfeitures to obtain effective counsel and make themselves whole. United States v. $60,201, 291 F. Supp. 2d 1126, 1130 (C.D. Cal. 2003).

Additionally, Congress enacted a fee-award provision in CAFRA that makes it easier for property owners to recover attorney’s fees when they prevail in a forfeiture case. CAFRA’s purpose includes leveling “the playing field between the government and persons whose property has been seized.” United States v. Section 9, 241 F.3d 796, 799 (6th Cir. 2001).

In particular, the attorney fee provision of CAFRA broadens the class of owners who can claim fees to all those who “substantially prevail”. Unlike the fees under the Equal Access to Justice Act (EAJA), CAFRA places no statutory hourly limit on fees.

CAFRA’s provision for awarding attorney fees requires the payment of fees even when the Government may have had a strong circumstantial case. See United States v. $186,416, 642 F.3d 753, 756 (9th Cir. 2011).

Reasons Why the Courts Should Award Attorney Fees in Forfeiture Cases

LA Times (6-09-2021): FBI wants to keep fortune Beverly Hills Seizure. Is it abuse of power?

LA TIMES (9-23-2022): FBI misled judge on Beverly Hills safe deposit box seizure

LA TIMES (5-10-2022): FBI gives up attempt to confiscate $1 million in California pot-store cash

USA Today (7-16-2021): Innocent people shouldn’t lose cash to police in forfeiture

Should the Government Be Liable for Attorneys’ Fees Incurred Before the Complaint Was Filed?

The government might contend that it should not be liable for attorneys’ fees incurred before its verified complaint was filed. The courts have found that “separating pre-complaint fees from post-complaint fees and awarding only the latter would deviate from the purpose of the Civil Asset Forfeiture Reform Act’s (“CAFRA”) fee-shifting provision.” United States v. $89,600, 2011 U.S. Dist. LEXIS 151996, *6.

In United States v. Certain Real Prop., 579 F.3d 1315, 1323 (11th Cir. 2009), the court found that “[t]he CAFRA fee-shifting provision was designed to make claimants whole for their efforts to recover their property in a civil forfeiture action.” For this reason, the court should not demarcate the fee award in this fashion.

Can the Government Avoid Paying Attorney Fees By Filing a Motion to Dismiss

Can the government avoid paying the claimant’s attorney’s fees by filing a Motion to Dismiss voluntarily requesting dismissal pursuant to Rule 41(a)(2) of the Federal Rules of Civil Procedure? Yes, they can.

For this reason, the claimant should object to the government’s motion to dismiss without prejudice and file a response asking the court to deny the motion, or alternatively, dismiss with prejudice so the claimant would still be entitled to attorney’s fees under CAFRA, § 2465(b)(1). Additionally, the attorney should file a motion for attorney fees pursuant to the Court’s discretionary authority to award fees in connection with voluntary dismissal pursuant to Rule 41(a)(2).

In some cases, the government files a Motion to Dismiss voluntarily requesting dismissal pursuant to Rule 41(a)(2) of the Federal Rules of Civil Procedure so that it can avoid paying the Claimant’s attorney fees. By filing the motion to dismiss, the government can later argue that the claimant did not “substantially prevail” based on the fact that the underlying forfeiture action was voluntarily dismissed without prejudice.

In those cases, the claimant should object to the government’s motion to dismiss, especially if a motion for summary judgment or a motion to suppress because of an illegal seizure is already pending. Even if the case is dismissed at the request of the government, the claimant should file a Motion for Attorney Fees pursuant to 28 U.S.C. § 2465(b)(1).

After an opposing party has served an answer or a motion for summary judgment, “an action may be dismissed at the plaintiff’s request only by court order, on terms that the court considers proper.” Fed. R. Civ. P. 41(a)(2). When considering such a request to dismiss, “the district court must exercise its broad equitable discretion under Rule 41(a)(2) to weigh the relevant equities and do justice between the parties in each case, imposing such costs and attaching such conditions to the dismissal as are deemed appropriate.” McCants v. Ford Motor Co., 781 F.2d 855, 857 (11th Cir. 1986).

In McCants v. Ford Motor Co., 781 F.2d 855, 860, the court noted: A plaintiff ordinarily will not be permitted to dismiss an action without prejudice under Rule 41(a)(2) after the defendant has been put to considerable expense in preparing for trial, except on condition that the plaintiff reimburses the defendant for at least a portion of his expenses of litigation.

Costs may include all litigation-related expenses incurred by the defendant, including reasonable attorney’s fees. See Bishop v. West American Insurance Co., 95 F.R.D. 494, 495 (N.D. Ga. 1982).

In Minh Huynh, 2009 WL 1685139, at *2, the Fifth Circuit recently addressed this situation. In Minh Huynh, the government filed a civil forfeiture action against a BMW vehicle owned by the claimants. Shortly thereafter, the government filed a motion to dismiss the case without prejudice and returned the vehicle to the claimants. In affirming a magistrate judge’s denial of attorney’s fees pursuant to § 2465(b)(1), the Fifth Circuit explained:

[T]he Government’s dismissal without prejudice [does not] bestow prevailing party status on Plaintiffs because it affected no “change in the legal relationship of the parties.” Buckhannon Bd. & Care Home, Inc. v. W. Va. Dep’t of Health & Human Res., 532 U.S. 598, 605 . . . (2001); see also, e.g., RFR Indus., Inc. v. Century Steps, Inc., 477 F.3d 1348, 1353 (Fed. Cir.2007) (reasoning that voluntary dismissal that leaves the plaintiff free to refile his claim affects no change in the parties’ legal relationship).

The return of the plaintiff’s car did nothing to prevent the Government from seizing it again. Additionally, the court entered no order with respect to the car addressing the merits of the forfeiture claim prior to its voluntary dismissal. Without the “necessary judicial imprimatur,” Plaintiffs cannot establish prevailing party status as to this action. Buckhannon, 532 U.S. at 605 . . . (emphasis removed). Id.

Likewise, in U.S. v. $13,275.21, 2007 WL 316455, the Western District of Texas applied Buckhannon to conclude that the claimant cannot obtain a mandatory award of attorney’s fees and costs pursuant to section 2465(b)(1)(A) because he did not substantially prevail since the government’s motion to dismiss without prejudice was granted. However, the claimant might be able to obtain a discretionary award of attorney’s fees and costs pursuant to Rule 41(a)(2), which gives the Court the authority to condition a plaintiff’s voluntary dismissal “upon such terms and conditions as the court deems proper.” Id. at *5.

In United States v. Certain Real Property, 543 F. Supp. 2d 1291 (N.D. Ala. 2008), the Northern District of Alabama applied Buckhannon as the governing standard. In that case, however, the court ultimately granted the claimant’s motion for attorney fees.

After the government filed a motion to dismiss the complaint without prejudice, the claimant filed a response indicating that they did not oppose dismissal but requested that the action be dismissed with prejudice so they would still be entitled to attorney’s fees under CAFRA, § 2465(b)(1). Id. at 1292. The court noted its discretionary authority to determine whether a Rule 41(a)(2) dismissal should be with or without prejudice, and the Court dismissed the case with prejudice. Id.

In court determined that the claimant’s acquittal in the underlying criminal case eliminated any possibility that the government would pursue renewing its civil forfeiture action. Id. Having dismissed the case with prejudice, the Court decided that the claimants had “substantially prevailed” making them entitled to an award of attorney’s fees pursuant to § 2465(b)(1)(A). Id. at 1293.

For this reason, the claimant should object to the government’s motion to dismiss without prejudice, and file a response asking the court to deny the motion, or alternatively, dismiss with prejudice so the claimant would still be entitled to attorney’s fees on a mandatory basis under CAFRA, § 2465(b)(1). The Claimant should also move for attorney fees pursuant to the Court’s discretionary authority to award fees in connection with voluntary dismissal pursuant to Rule 41(a)(2).

In the response to the government’s motion for dismissal without prejudice, it is important for the claimant to respond by showing: the claimant’s effort and expense in preparing for trial; excessive delay or lack of diligence on the part of the government; insufficient explanation of the need for dismissal; and

the present stage of litigation (i.e., whether a motion to suppress or motion for summary judgment is pending).

Additionally, the claimant’s response to the government’s request to dismiss without prejudice should show: the substantial rights that would be lost by the dismissal including the fact that a dismissal without prejudice plainly prejudices the claimant because it prevents the claimant from obtaining statutory attorney’s fees pursuant to the Civil Asset Forfeiture Reform Act of 2000, 28 U.S.C. § 2465(b)(1); why the government’s conduct evinced bad faith; why the government sought the dismissal to gain a “strategic advantage” or as an exercise of “procedural gamesmanship” so that the motion for summary judgment or motion to suppress the illegal search would not be granted and it would not be liable for attorney fees; the government did not offer a plausible reason for seeking dismissal other than gaining a strategic advantage; the government did not believe it had a meritorious case for forfeiture; it matters whether the government or the claimants had superior title to the property; the dilatory tactics by the government as evidenced by the duration of the action; the amount of effort and resources expended; and the dismissal would not result in a waste of judicial time and effort.

Additionally, the claimant should argue that the duration of the litigation and their pending dispositive motion at the time the government requested dismissal weigh against voluntary dismissal without prejudice.

The loss of a basis for statutory attorney’s fees constitutes plain legal prejudice. In other words, the loss of a right to attorney’s fees is sufficient legal prejudice that requires dismissal with prejudice. The claimant should also move for attorney’s fees, costs, and interest under the Civil Asset Forfeiture Reform Act, see 28 U.S.C. § 2465(b)(1). A dismissal without prejudice would likely prevent the claimant from recovering attorney fees and costs under CAFRA, or at least make such recovery significantly more difficult. Under CAFRA, a claimant is entitled to attorney fees, litigation costs, and interest if he “substantially prevails” in a civil forfeiture proceeding. 28 U.S.C. § 2465(b)(1).

If a court is convinced that dismissal without prejudice at the government’s request would cause legal prejudice to a claimant by unfairly depriving the claimant of the ability to seek attorney fees under CAFRA, then the court may deny the government’s motion. See United States v. $107,702.66 in U.S. Currency, No. 7:14-CV-00295-F, 2016 U.S. Dist. LEXIS 12211, 2016 WL 413093, at *3-4 (E.D.N.C. Feb. 2, 2016); see also United States v. Ito, 472 F. App’x 841, 842 (9th Cir. 2012).

Pre-Judgment and Post-Judgment Interest under CAFRA

Under 28 U.S.C. § 2465(b)(1)(B), (C)(ii), the successful claimants of civil asset forfeiture cases involving currency are also entitled to pre-judgment and post-judgment interest when the claimant has substantially prevailed in the litigation.

In these cases, the claimant will request an award of the interest paid to the United States from the date the currency was seized pursuant to 28 U.S.C. § 2465(b)(1)(C)(i). The claimant might also seek an award of imputed interest pursuant to 28 U.S.C. § 2465(b)(1)(C)(ii), for any non-excluded time period during which interest was not paid on the funds.

The statute provides that the “United States shall be liable for – in cases involving currency, … (i) interest actually paid to the United States from the date of seizure or arrest of the property that resulted from the investment of the property in an interest-bearing account or instrument; and (ii) an imputed amount of interest that such currency, instruments, or proceeds would have earned at the rate applicable to the 30-day Treasury Bill, for any period during which no interest was paid (not including any period when the property reasonably was in use as evidence in an official proceeding or in conducting scientific tests for the purpose of collecting evidence), commencing 15 days after the property was seized by a Federal law enforcement agency, or was turned over to a Federal law enforcement agency by a State or local law enforcement agency. 28 U.S.C. § 2465(b)(1)(C).

Pursuant to §2465(b)(1)(B) and 28 U.S.C. § 1961, the Claimant is entitled to post-judgment interest from the date of the Judgment until the property is returned.

Should the Government Pay Attorney Fees and Costs to the Claimant’s Attorney or the Claimant?

CAFRA does not explain whether an award of attorney fees should be paid to the Claimant’s attorney or directly to the Claimant. Although policy justifications support awarding attorney fees and costs to the claimant’s attorney directly rather than to the client. If fee awards are paid to the claimant, then attorneys may not be paid for their work. That problem reduces the likelihood of competent representation which undermines the goals of CAFRA.

Section 2465(b)(2)(C) of Title 28 of the United States Code provides a defense for the United States when the payment of attorney fees is requested by one or more claimants: (C) If there are multiple claims to the same property, the United States shall not be liable for costs and attorneys fees associated with any such claim if the United States – (i) promptly recognizes such claim; (ii) promptly returns the interest of the claimant in the property to the claimant, if the property can be divided without difficulty and there are no competing claims to that portion of the property; (iii) does not cause the claimant to incur additional, reasonable costs or fees; and (iv) prevails in obtaining forfeiture with respect to one or more of the other claims. 28 U.S.C. § 2465(b)(2)(C).

Attorney Sebastian Rucci Focuses His Law Practice on Seizures and Asset Forfeitures

Forfeiture Attorney Sebastian Rucci has 27 years of legal experience and FOCUSES HIS PRACTICE ON SEIZURES AND ASSET FORFEITURES. He also works with other attorneys co-counsel on civil asset forfeiture cases.

Forfeiture attorney Sebastian Rucci will challenge federal asset forfeiture cases throughout the United States. He can file a verified claim for the seized assets, an answer challenging the allegations in the verified forfeiture complaint, seek an adversarial preliminary hearing if one was denied, and challenge the seizure by filing a motion to suppress and dismiss on multiple procedural grounds demanding the immediate return of the seized assets.

Forfeiture attorney Sebastian Rucci can show that the seized assets are not the proceeds of criminal activity and that the agency did not have probable cause to seize the funds or other assets. Even if a showing of probable cause has been made, he can file to rebut the probable cause by demonstrating that the forfeiture statute was not violated, that the agency failed to trace the funds, or showing an affirmative defense that entitles the immediate return of the seized assets.

Forfeiture attorney Sebastian Rucci is available as co-counsel, working with other counsel, where he focuses on challenging the asset forfeiture and seizure aspect of the case throughout the United States. Forfeiture attorney Sebastian Rucci often takes civil asset forfeiture cases on a contingency fee basis, which means that you pay nothing until the money or other asset is returned. Let experienced forfeiture attorney Sebastian Rucci put his experience with federal seizures and forfeiture actions to work for you, call attorney Sebastian Rucci at 330-720-0398.