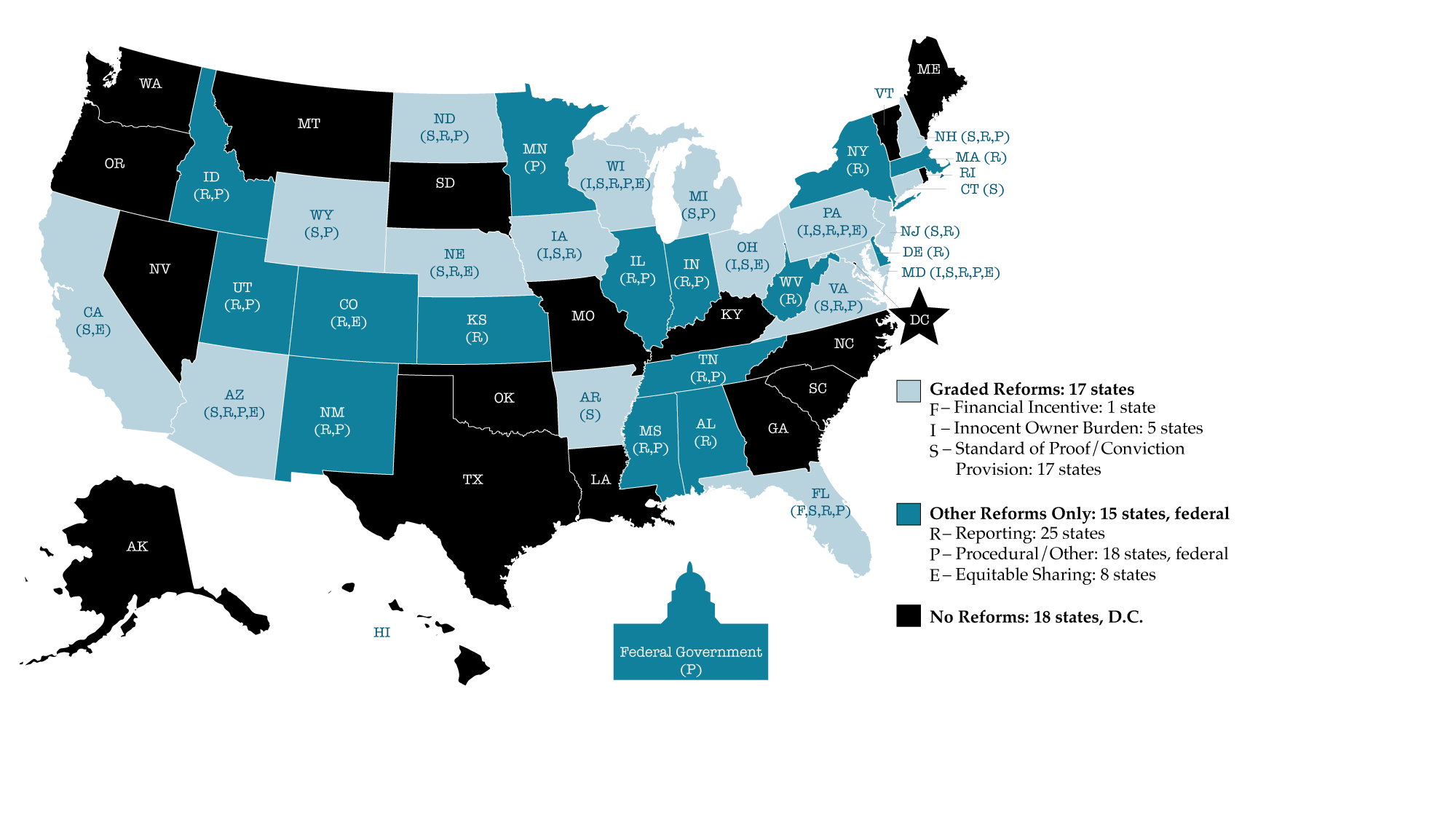

Civil Asset Forfeiture: Grading the States

Civil asset forfeiture is a unique area of law in which the government charges specific property of being guilty of wrongdoing, rather than a person. Perhaps because the property is accused of wrongdoing, and not the person, governments often place lower standards of proof needed to forfeit the property. The procedures used by the federal government and many state governments creates grave Fourth and Fifth Amendment concerns.

Since 2008, the federal government has regularly brought in over $1 billion a year in forfeiture proceeds. Although most states lack reporting requirements that would allow us to track forfeiture proceeds, those that do report reveal that states regularly bring in millions of dollars each year.

While civil asset forfeiture has been used as a funding source since our country’s founding, the practice has accelerated at the state and local level since the 1980s. With the creation of new taxes (income, sales, property, corporate) civil asset forfeiture should no longer be needed to raise revenue for governments that have plenty of other revenue streams.

In the wake of rising public outcry against abusive civil asset forfeiture laws, states such as Minnesota, New Mexico, and Montana have led the reform movement, and other states such as California, Michigan, and Pennsylvania are in the midst of meaningful discussions about reforms. While this movement is great, more states and the federal government, need to follow their lead and reform their own civil asset forfeiture laws.

With civil asset forfeiture becoming a bigger issue at the state and federal levels, FreedomWorks has released its guide to Grading the States on this important issue. As can be seen by the grades of the states and federal government, there are still plenty of reforms to be implemented before this travesty of justice is corrected.

![topicsdrugs[1]](https://rucci.law/wp-content/uploads/2023/12/topicsdrugs1.jpg)