Seizure of Bank Accounts

If funds in a bank account are frozen, blocked, or seized under federal law. See 21 U.S.C. § 881(a)(6) and 31 U.S.C. § 5317(c)(2) or 18 U.S.C. §§ 1029, 500, and 513 by federal agencies including the United States Secret Service or the Federal Bureau of Investigations call experienced forfeiture attorney Sebastian Rucci.

When the authorities with the state or federal government seize money directly from a bank account, the bank records might show a large number of cash deposits under the $10,000 threshold that must be reported to the government.

Alternatively, law enforcement officers might look for evidence that money in a bank account was obtained in violation of state and federal law from the fraudulent use of access devices, counterfeited money orders, or other counterfeited securities.

Additionally, the United States Secret Service has begun seizing funds from bank accounts based on allegations of fraudulently obtained PPP loans or fraudulently obtained COVID-19 Economic Injury Disaster Loan (EIDL) loans related to the Cares Act. Seizures in these cases are based on violations of Titles 18 USC 1014 (loan or credit application fraud) or 18 USC 1343 (wire fraud).

Under federal law, CAFRA has similar notice requirements listed in 18 USC 981. In some cases, the notice is sent via certified mail. If you file a verified claim for the money seized, then an attorney for the law enforcement agency that seized the funds from the bank account might file a Complaint/Petition for Judgment of Forfeiture. The allegations in the Complaint are often verified by the law enforcement officer, detective, or special agent that investigated the case.

Newspaper Articles About Forfeiture Abuses

Homeland Security (9-09-2014): ICE agents seize $65 million in bank deposits

CNN (1-31-2022): FBI illegally seized cash belonging to licensed dispensaries

CNBC (10-20-22): Customers battle to regain billions in bitcoin the DOJ seized

LA TIMES (9-23-2022): FBI misled the Judge on Beverly Hills safe deposit box seizure

USA Today (7-16-2021): Innocent people shouldn’t lose cash to forfeiture

Attorney for Bank Account Seizures for Forfeiture

If you received a notice that a local, state, or federal government agency seized funds from your bank account for forfeiture, then contact experienced asset forfeiture attorney Sebastian Rucci. Attorney Sebastian Rucci has 27 years of legal experience and focuses his practice on seizures and asset forfeitures.

The notice that funds were seized for forfeitures from bank accounts explains that a forfeiture action is pending. In federal asset forfeiture cases, we represent clients throughout the United States. We help our clients file a verified claim to demand court action regarding the funds.

If the funds were seized by a federal agency, you can immediately file a verified claim for court action which triggers a 90-day deadline for the agency to either refund the money or file a complaint in the U.S. District Court. For forfeitures under state law, any person entitled to notice as to the seizure of the funds from the bank account and those who have legal standing to contest the seizure may request an adversarial preliminary hearing within 15 days in a civil asset forfeiture proceeding.

Act quickly. If you want to contest the seizure of funds in a bank account, your best chance of getting the money back quickly often requires demanding an adversarial preliminary hearing immediately after receiving the notice or filing a claim. Do NOT wait until the end of the 15 days because you must ensure the demand for an adversarial preliminary hearing is RECEIVED within the time provided.

An attorney can help you file a timely demand for the adversarial preliminary hearing by notifying the agency’s counsel, in writing, via certified mail within 15 days of receiving any Notice of Seizure. If the demand is not timely or otherwise invalid, you might inadvertently waive your right to an adversarial hearing. Forfeiture attorney Sebastian Rucci can help you file a claim for the seized property and litigate a demand for the adversarial preliminary hearing.

Seizures of Bank Accounts by the U.S. Secret Service

If the United States Secret Service seized funds from your bank account for civil asset forfeiture proceedings, you will receive a letter from the customer outreach department or the garnishment processor working at the bank. The letter explains how much money was seized from your bank account and instructions on how to challenge the seizure.

Instead of representing yourself by submitting a petition for remission or mitigation, the better course of action is to retain an attorney to help you submit a verified “claim for court action” form.

The notice of seizure might claim that the money was seized for forfeiture by the United States Secret Service from a United States bank pursuant to Title 18 U.S.C. 981 as properties that were used or acquired by violation of Title 18 U.S.C. 1343 (the federal wire fraud statute).

Civil forfeitures laws permit law enforcement to seize property without a conviction and keep what they seize, this has warped law enforcement priorities and decimated public trust in law enforcement.

Judgment of Forfeiture

After the agency files its Amended Complaint/Petition for Judgment of Forfeiture and verified affidavits in support of the complaint, the court might enter an order finding that the agency had established probable cause to maintain this forfeiture action regarding the bank accounts.

The court will consider whether the deposits into the bank account significantly exceed the annual gross income that the owner of the bank account reported to the Internal Revenue Service. The court will also consider whether the owner of the bank account alleges any facts that would legitimize any unreported income or rebut the agency’s allegations that the currency in the Bank Accounts constitutes the proceeds of criminal conduct.

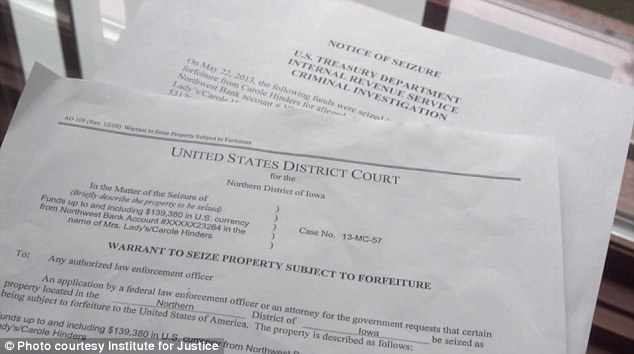

Seizure Warrant for Funds in Bank Account

The garnishment processor working at the bank might send you a letter explaining that the bank has received a legal document directing it to freeze and block your accounts with the bank. The hold will typically remain on the account unless the bank receives: a court order directing the bank not to comply with the document; or a written direction from the party that delivered these papers excusing the bank from compliance

Federal agents might request a Seizure Warrant from a judge in the United States District Court concerning money in a bank account after alleging the money is subject to seizure and forfeiture pursuant to 18 U.S.C. § 981(a)(1)(C) and § 982(b) and § 984 and 21 U.S.C. § 853(f) concerning a violation of 18 U.S.C. § 1341 and § 1343.

The warrant request might include an affidavit and recorded testimony establishing probable cause to believe the property is subject to seizure and that grounds exist for the issuance of a search warrant.

The seizure warrant might order the bank to accept all incoming credits to the account listed above while not allowing any withdrawals or other disbursement of funds for 14 days after the warrant is issued.

The seizure warrant might order the bank to deliver the funds immediately and upon presentation of this warrant to the law enforcement agency serving the warrant in the form of a cashier’s check made payable to the United States Marshal Service.

The seizure warrant might command the bank to seize the property, leave a copy of the warrant and receipt for the property seized and prepare a written inventory of the property seized, and return this warrant through a filing with the clerk’s office. The clerk might issue a Warrant for Arrest for the defendant’s funds obtained from the bank.

In these cases, the federal agency is seeking the entry of a Final Judgment of Forfeiture, for the U.S. Currency, together with any interest that may have accrued on the total amount seized so that it can be forfeited to the United States government pursuant to 21 U.S.C. § 881(a)(6), to be disposed of according to federal law.

Civil asset forfeiture is state-sanctioned robbery and is the great injustice of our time.

Attorney Sebastian Rucci focuses on Seizures and Asset Forfeitures

Forfeiture Attorney Sebastian Rucci has 27 years of legal experience and focuses his law practice on seizures and asset forfeitures. He also works with other attorneys co-counsel on civil asset forfeiture cases.

Forfeiture attorney Sebastian Rucci will challenge federal asset forfeiture cases throughout the United States. He can file a verified claim for the seized assets, an answer challenging the allegations in the verified forfeiture complaint, seek an adversarial preliminary hearing if one was denied, and challenge the seizure by filing a motion to suppress and dismiss on multiple procedural grounds demanding the immediate return of the seized assets.

Forfeiture attorney Sebastian Rucci can show that the seized assets are not the proceeds of criminal activity and that the agency did not have probable cause to seize the funds or other assets. Even if a showing of probable cause has been made, he can file to rebut the probable cause by demonstrating that the forfeiture statute was not violated, that the agency failed to trace the funds, or showing an affirmative defense that entitles the immediate return of the seized assets.

Forfeiture attorney Sebastian Rucci is available as co-counsel, working with other counsel, where he focuses on challenging the asset forfeiture and seizure aspect of the case throughout the United States. Forfeiture attorney Sebastian Rucci often takes civil asset forfeiture cases on a contingency fee basis, which means that you pay nothing until the money or other asset is returned. Let experienced forfeiture attorney Sebastian Rucci put his experience with federal seizures and forfeiture actions to work for you, call attorney Sebastian Rucci at 330-720-0398.